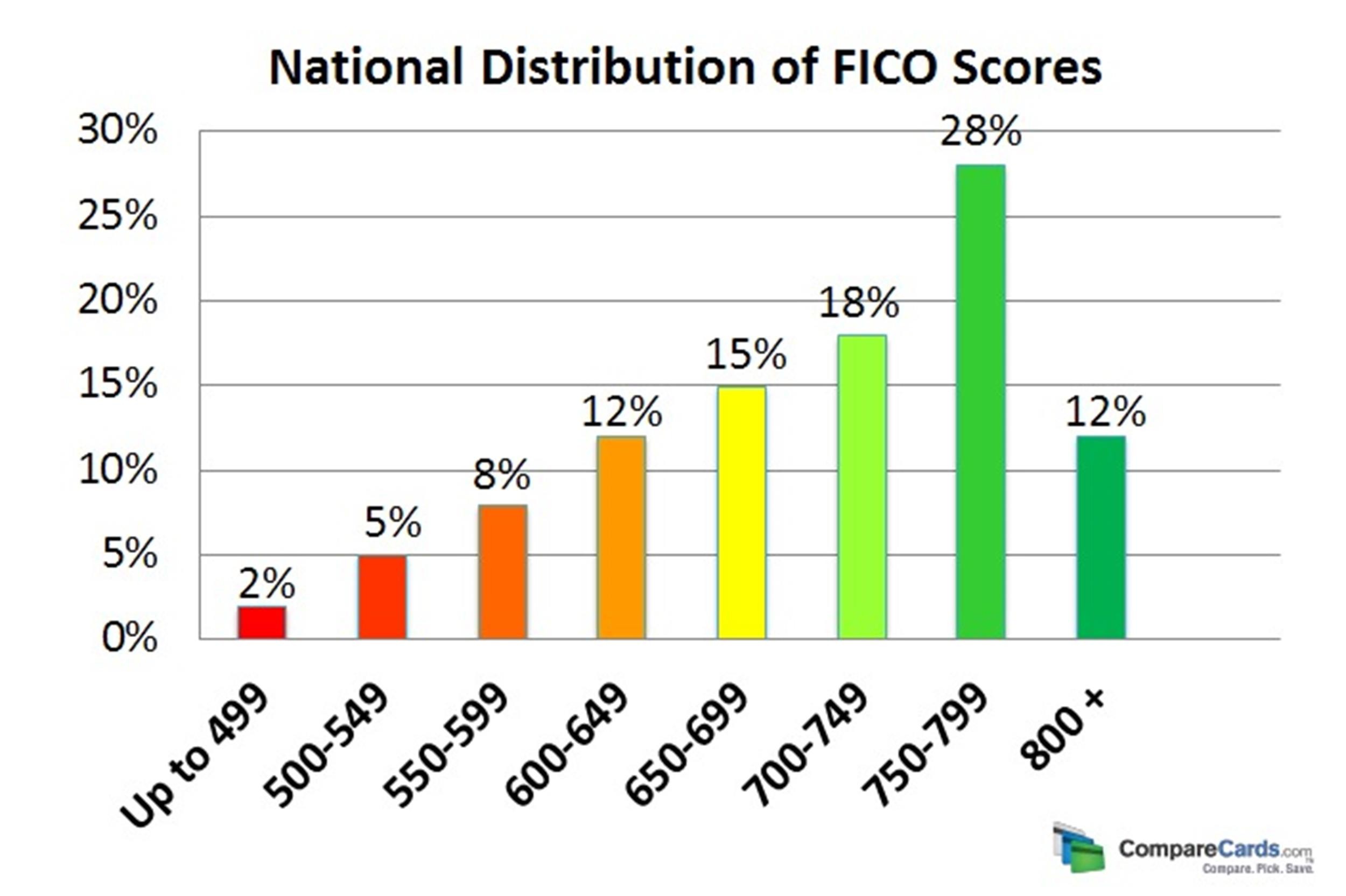

The FICO models compare consumers and, essentially, rank them based on their likelihood to repay credit obligations as agreed.

Unarguably the most recognizable credit score model, the FICO® Score was introduced by the Fair Isaac Corporation in 1989 as an objective tool for evaluating borrower credit risk. While these are not the only models used, they are, by far, the most common. The two main types of scoring models used by Equifax, Experian, and TransUnion for most lenders are from FICO and VantageScore. The model then calculates a credit score based on predetermined criteria such as payment behavior and total debt. When a credit bureau receives a credit score request, the relevant data from your credit report is collected and run through what’s called a scoring model, a type of proprietary algorithm. Not every creditor will always report to all three bureaus, so some credit information may appear on your Experian report, for instance, but be missing from your TransUnion report. This information makes up your individual credit history and report.īeyond the scoring model used, credit scores can also vary by credit bureau because of reporting inconsistencies across bureaus. This generally means requesting a credit score from one (or all) of the three major credit bureaus, Equifax, Experian, and TransUnion.Įach bureau maintains a database of financial information reported to them by various creditors and financial institutions.

Though some lenders prefer to use their own in-house or customized risk-assessment models, the majority of companies looking to assess your credit risk will use your credit score as a deciding factor.

0 kommentar(er)

0 kommentar(er)